Parts cleaning industry mood barometer 2024 - Interview with Gerhard Koblenzer, CEO LPW Cleaning Systems

The mood in the parts cleaning industry is subdued. Gerhard Koblenzer, CEO of LPW Cleaning Systems, explains in an interview with Surface Technology Online editor-in-chief Oliver Missbach why complaining is useless and what ways out of the crisis could look like.

The year 2024 is almost halfway through - and the mood in the industry is largely poor. In addition to the crisis fatigue of recent years, there is a lack of perspective and predictability. The global industrial structural change is hitting manufacturing companies and their capital goods suppliers hard, while the reluctance to invest in the core regions of Europe, North America and Asia is causing even more uncertainty. Surface Technology Online spoke to Gerhard Koblenzer, CEO of LPW Cleaning Systems, about the current situation and how to overcome the paralysis and poor mood.

Gerhard Koblenzer: "The plant and mechanical engineering sector has been hit hard and is suffering greatly. On the one hand, massive investments have to be made in new products and services. On the other hand, the "bread and butter business" is almost completely collapsing. A toxic combination that is particularly evident in the automotive industry. The first signs of structural change were already recognizable ten years ago. However, they were often ignored or there was simply no time to deal with them. The bill has been paid since 2019. Today, hardly any new product lines are being developed in the classic powertrain segment. In the truck segment, new investments in the military and construction machinery industry are evident, but they do not compensate for the weakness in the passenger car segment. Although investments in e-mobility and fuel cells are continuing, they are currently restrained. As a result, medium-sized suppliers in particular lack the orientation on which to invest. Of course, this also has a massive impact on industrial parts cleaning. While, on the one hand, work on customer-specific large-scale projects is progressing at a very high level, there is an almost complete lack of smaller and medium-sized projects."

Gerhard Koblenzer: "Well, I don't really see a general upturn. However, not everything is as bad as it is made out to be. A lack of planning certainty due to a lack of guidelines from large-scale industry and politicians does not necessarily make day-to-day work any easier. But this is not just a German or European issue. Apart from that, there are also growth sectors. These include high vacuum and sensor technology and the optical industry. There are also new tasks for additive manufacturing, innovations in mobility concepts or energy generation. This offers many opportunities, including for realignment. In the machining industry in particular, cleanliness requirements are increasing, while the quantities to be produced are tending towards small series and customer-specific individual components. This requires a focus on the overall processes in planning, implementation and optimization. This is actually a core competence in German-speaking countries."

Question: "In a globalized world, the economic situation does not only depend on local factors. The German cleaning industry also relies heavily on foreign markets such as North America. A new president will be elected in the USA on November 5, 2024. A recent study by the German Economic Institute (IW) expects that a possible second Trump term could cost the German economy up to 150 billion euros due to planned new tariffs on imports. How is the cleaning industry preparing for this and what can we expect here?"

Gerhard Koblenzer: "The North American economy is currently waiting for the election in November. As a result, the willingness to invest is currently rather restrained. Regardless of the outcome of the elections, it can be assumed that the protectionist behavior of the United States will continue. In the case of President Trump, it will only become more unpredictable. However, experience with his last presidency has shown that those German capital goods suppliers who have no or no adequate competitors in the US will continue to receive their orders - only at significantly higher costs for US customers. Another reason to focus on those competencies that traditionally characterize our industry."

Gerhard Koblenzer: "Basically, as in the late 90s, more flexibility and an analytical approach are needed again. We can do that! Back to the roots means that we are now focusing on the basics of industrial cleaning technology and technical cleanliness in production processes, adapted to today's much more demanding cleanliness requirements. Over the years, this has been pushed into the background by the automotive focus. In addition to experience and professional project management, solution-oriented communication is also necessary. Especially between management, engineering, manufacturing and production. On the one hand, this requires the appropriate technical qualifications at all levels and, on the other, a management mentality that allows and encourages constructive criticism. This is also a clear strength in German-speaking countries."

Gerhard Koblenzer: "Definitely yes. It has never made sense for the German mechanical and plant engineering industry to compete 1:1 with local companies in North America and Asia. However, value-added products and services are required in terms of quality and performance. These can then be positioned at a correspondingly high price and will continue to find customers. The parts cleaning industry in particular benefits from the fact that almost all new industrial developments are associated with higher cleanliness requirements for the product and the entire manufacturing process. We can do this better than others in Central Europe!"

Gerhard Koblenzer: "Political decisions partly influence how and at what speed the economy adapts to change. They can also provide incentives to accelerate processes. This applies, for example, to infrastructure, the implementation of measures to achieve CO2 neutrality or the development of a defense capability to reduce political blackmail. However, politics has little influence on global change processes. However, it can increase the willingness to invest through targeted temporary subsidies and the establishment of stable framework conditions. This is currently lacking. Above all, SMEs need a reliable planning horizon for the next seven to ten years."

Gerhard Koblenzer: "It makes no sense to hold on to the old business and achievements alone. And it makes even less sense to moan about the inevitable changes. The new megatrends in society, industry and international weight distribution were already apparent many years ago. Added to this are the direct and indirect costs of the climate crisis. The national economy and companies currently have to spend considerable amounts of money to repair the damage caused by floods, hail and heat, for example. In the absence of other options and due to a lack of self-reflection, there is a tendency to recklessly pass the buck to politicians. You can do that, but it doesn't help. Nor does it relieve companies of their own responsibility. The shift is therefore initially about acceptance, tolerance and openness."

Gerhard Koblenzer: "This reorganization of technologies and framework conditions offers a multitude of opportunities for new products and services. Not only in Germany, by the way. Due to the lack of real alternatives, we need to actively tackle this and set ourselves individual and autonomous interim goals as a company for the next one to four years. This is the benchmark for each individual decision and this is how the process gets going. Then you have to keep at it and, above all, get people excited about the change and take it with you. This is the biggest challenge due to the lack of constants and stability. We have the technological skills!"

Contact

LPW Reinigungssysteme GmbH

Industriestrasse 19

72585 Riederich (Germany)

P.O. Box 11 64, 72585 Riederich

Phone: +49 (0)71 23 - 38 04-0

E-mail: info@lpw-reinigungssysteme.de

www.lpw-reinigungssysteme.de

About LPW Cleaning Systems

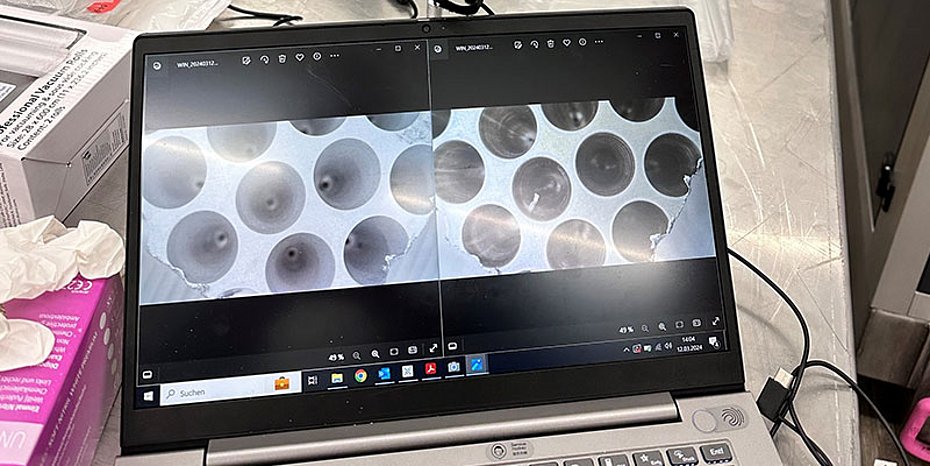

LPW Reinigungssysteme GmbH is one of the leading suppliers of high-quality systems and process technologies for industrial component cleaning with aqueous media. The systems are used in the mechanical engineering, automotive, aerospace and general industry sectors, among others. With its High Purity division, LPW is also a sought-after partner in sectors with fine and ultra-fine cleaning tasks such as the medical technology, optical and semiconductor industries.