Industrial parts cleaning trends and prospects for 2025 - Interview with Gerhard Koblenzer, CEO LPW Reinigungssysteme

What trends and prospects are emerging in industrial parts cleaning in 2025? Gerhard Koblenzer, CEO of LPW Reinigungssysteme, talks about this in an interview with Oliver Missbach, editor-in-chief of Surface Technology Online.

Gerhard Koblenzer: "The year 2024 was associated with a number of expectations. The new business areas in particular, e.g. in high vacuum technology, e-mobility, aerospace technology and parts of medical technology, had geared their procurement plans towards the start of production in 2025. This was also clearly reflected in inquiries at the turn of the year and continues to be the case. However, for a variety of reasons, investment decisions are not being made, or only to a limited extent. At the beginning of the year, it was mainly medium-sized customers in the supply chains of large OEMs and Tier 1s that were holding back their investments due to the economic uncertainties, but large companies are now also postponing their investment plans. This had a negative impact on 2024 and is also clearly clouding expectations for the coming year, especially for the first half of the year. The reasons vary. In the automotive segment, there is almost a complete standstill. The old "Powertrain" business is virtually non-existent in terms of capital goods, and the new tasks are not getting off the ground, and not just in Germany. There was a small flash in the pan in the production of large diesel engines. Aerospace is moving in small steps, defense is faltering and demand from medical technology is also subdued. In the last quarter of 2024, a large number of procurement projects in high vacuum technology were also halted and postponed to the new year. This was triggered by the supposedly poor business figures of the major OEMs in Europe and the US."

Gerhard Koblenzer: "Politics has no direct influence on global trends and the associated structural changes, including in industrial production. It cannot create them, nor can it effectively prevent them, but it creates essential framework conditions for whether they are implemented faster or slower and how one reacts to them. Unfortunately, it is currently creating maximum uncertainty and planning insecurity, and not just in Germany. At a difficult economic time, in the middle of an industrial structural change, the old industries are being weakened and the new ones are not being supported in the long term. The result is a toxic reluctance to invest in almost all industrial sectors. It is also fair to ask how the change of government in the USA next year will affect the economic outlook. Almost any scenario is possible here and, ultimately, the impact will depend to a large extent on how Europe, and Germany in particular, reacts to possible changes. It remains exciting..."

Gerhard Koblenzer: "The motivation level in the industry is currently as low as the order intake. Incoming orders in 2024 were low and very uneven. As a result, many companies were forced to apply for short-time working for parts of their workforce or reduce staff. Nevertheless, many companies in the sector are starting the new year with a reasonable basic order backlog for the first half of the year. As in previous years, the distribution of orders and the respective volumes are causing capacity utilization to fluctuate greatly. The key question is how business will develop in the first quarter. However, the coming year also offers opportunities. The requirements for technical cleanliness in process chains are set to increase worldwide, particularly in the promising high-tech sectors. As a result, the demand for high-quality industrial cleaning systems will also increase in the medium term. In principle, the prospects are good for all companies involved in clean production processes. In the short term, there are two main challenges that need to be solved: We are seeing a significant increase in the need for support in setting up ultra-clean processes and an expanded understanding of processes in almost all industries. This also has an impact on the demand for customized ultra-fine cleaning systems. On the other hand, the economically strapped supply industry in almost all sectors must be supported in optimizing existing capacities and supplementing them with affordable cleaning solutions to increase the quality of cleaning and in the process. This offers opportunities for our contract cleaning and consulting division and also for our modular standard solutions for the step-by-step development of ultra-clean process chains."

Gerhard Koblenzer: "The industry has changed significantly in recent years. In the last 20-30 years, ultrafine and ultra-fine cleaning was essentially a task for multi-bath ultrasonic system suppliers for tasks in areas such as medical technology, the optical industry or wafer cleaning. In the last 10-15 years, however, there has been a trend towards new tasks in high vacuum technology, sensor and analysis device technology, additive manufacturing and new tasks in the aerospace industry. The core of this was and is the combination of complex components with significantly higher purity requirements. In other words, what is known today as high purity. The trade fair landscape has not yet really adapted to these changes. When the German-dominated automotive business was still going well, the focus was clearly on the well-known market-dominating plant manufacturers, their supply chains and the accompanying mechanical engineering. This was also the orientation of the trade fair landscape. Parts2clean in particular was a trade fair for industrial parts cleaning in German-speaking countries with the aforementioned focus. Now the market has become international, highly flexible and process chain-oriented. The trade fair does not currently reflect this. It lacks the international audience, the exhibitors in the fields of monitoring, media, packaging & logistics and all those who deal with clean environmental conditions. The change to a 2-year cycle is the consequence of this. It gives exhibitors the opportunity to build other networks and attend those events that better represent the everyday market. While the LPW had already adapted to this trend early on, it was largely neglected by the majority of the industry in recent years. This changed abruptly in 2020/2021 and, with a little optimism, will also be reflected in the trade fair and event landscape in the coming years. In the meantime, everyone is a little high purity."

Gerhard Koblenzer: "The trade fair must actively open up to those process-related topics that have become increasingly important in the field of industrial cleaning technology. The focus must be placed more strongly on clean process chains, even in the formulation of the claim. The active inclusion of foreign markets is also necessary. The day-to-day business of existing exhibitors has become much more international. However, the trade fair is still focused on the DACH region. The plans for a comparable event in North America have practically come to nothing. With the dissolution of the partner association MCA and the reduction of Deutsche Messe's activities in this market, the key players are missing."

Gerhard Koblenzer: "What choice do you currently have? The market sets the requirements and you have to be broad enough to be able to react quickly. The sectors are known and the requirements are developing relatively clearly. The current balancing act hurts, but it has been part of everyday life in recent years. As the "old" business has effectively died and the new market segments are subject to strong fluctuations, it is difficult to specialize. Specialization will be possible again when the markets have calmed down and have a medium-term perspective on their processes. This will then increase the willingness of the medium-sized supplier industry to invest."

Gerhard Koblenzer: "Yes, it will! With direct local competition on the North American market, it will certainly be much more difficult. The industrial cleaning technology sector would of course also be affected, especially for simpler applications. In the high-quality sector with requirements for a high degree of automation or requirements in ultra-fine and ultra-fine cleaning, demand will be less affected due to a lack of local competitors. However, if the EU responds with countermeasures, which is to be expected, it will also become more difficult for US companies to sell their own products on the European market. Many Europeans are now trying to establish a foothold in the States. But the backlash is also recognizable. The resulting gaps in Europe must be closed. Companies from Asia in particular, and not just from China, are recognizing this trend and are already planning corresponding investments in the European market. This applies, for example, to high-vacuum technology and medical technology."

Gerhard Koblenzer: "Of course, one day we will have direct competition from Asia, especially for standardized systems. We already had the forerunners. There were already well-known manufacturers who had large parts of their plant technology prefabricated in Asia (e.g. in China or Malaysia). In addition, the range of local and very good manufacturers is also developing in the important core markets. It is only a question of time. This makes it all the more important to expand our own capabilities and adapt to the new requirements."

Gerhard Koblenzer: "Laying the foundations for medium-term and long-term planning. We cannot compete with the rest of the world on price. Either through product quality and degree of innovation or with core competencies that we in Central Europe can do better than the rest of the industrialized world. Process makers!!!"

Question: "Regarding the outlook for 2025: sustainability, energy efficiency and automation were also very present across the industry in 2024 and will probably remain so next year. Does this also play a major role for your customers and what specific impact will this have? Is there a trend towards low-temperature cleaning, for example?"

Gerhard Koblenzer: "Just a small remark: cold cleaning is always perfect if drying can be achieved with technically simple means. In all other cases, it makes no sense from an energy point of view to put several times as much energy into the air isolator for drying in order to achieve a small saving in the cleaning and rinsing baths. There are more intelligent approaches. True sustainability means resource efficiency while guaranteeing availability and validatable quality. The key to greater efficiency lies in automation and a new understanding of monitoring that goes far beyond the cleaning system. Networked process chains that react flexibly to changes only ever allow the use of resources that are necessary for the task at hand at that moment. However, we are still a long way from this in everyday life. LPW Application Engineering has been working on these issues with external partners for years, with increasing success."

Gerhard Koblenzer: "2025 will be another very difficult and challenging year. In the worst-case scenario, we can expect a repeat of 2024. In any case, it will be a considerable challenge at the beginning, with a very negative impact on companies, regardless of their size, especially in the first six months. However, LPW entered the difficult economic situation later and we have the opportunity to get through it more quickly, as we already prepared ourselves technologically for the changes many years ago. This is not possible without change and the constant need to rethink our own activities and structures. However, based on the current projects, I expect a positive development from the 2nd/3rd quarter of 2025, with positive effects on the turn of the year 2025/2026. However, the prerequisite is that no new crises arise that pose completely new challenges to our own resilience."

Gerhard Koblenzer: "If you look at the medium and long-term investment forecasts for cleanroom technology, the institutes expect average growth of 5 percent per year. In some sectors, such as medical technology or the semiconductor industry, this figure is even significantly higher. What does this have to do with us? Because cleanrooms do not clean, there is a steadily increasing demand for clean production chains and for integrated cleaning technology that can ensure the transfer from the production environment to these clean ambient conditions. And all this while raising the level of technical cleanliness in a process-reliable and traceable manner. In future, the focus on this sub-process will be of decisive importance. This quality gate requires close and clearly defined cooperation between, for example, the cleanroom constructor, the pre-process owner and the planner of the associated cleaning technology. From our everyday work at LPW over the past few years, we have learned that the discussion with the customer does not begin with the cleaning system. Rather, the focus is on ensuring cleanability in the pre-process, the quality of the media and auxiliary materials used, the qualifications of the employees and the safe and clean transfer of the components to clean ambient conditions. A technically demanding discussion about interfaces and process chains, with the aim of achieving and maintaining an ambitious level of technical cleanliness. The quality and functionality of the cleaning technology is a prerequisite and a consequence of the previous discussions. This also has consequences for the networks and cooperation with other companies. Whereas previously the focus was on cleaning technology and the associated processes, chemistry and media preparation, the focus is now on more intensive cooperation with players in the upstream and downstream processes. "How do I transfer the components from the upstream process?", "How do I define and implement the interface to the cleanroom?" or "How do I create cross-process monitoring?" are common questions, for example. Suppliers of cleaning systems are increasingly becoming service providers in ultra-clean process chains, with a strong system construction division."

Contact

LPW Reinigungssysteme GmbH

Industriestraße 19

72585 Riederich (Germany)

P.O. Box 11 64, 72585 Riederich

Phone: +49 (0)71 23 - 38 04-0

E-mail: info@lpw-reinigungssysteme.de

www.lpw-reinigungssysteme.de

About LPW Reinigungssysteme GmbH

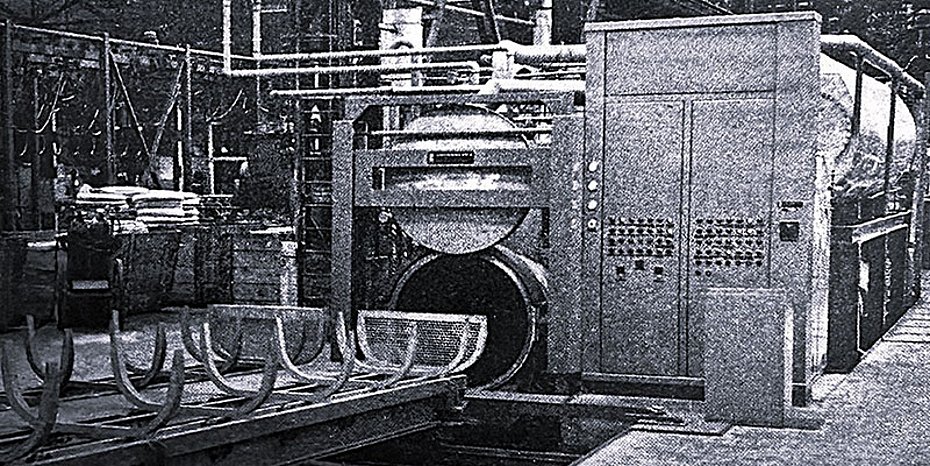

LPW Reinigungssysteme GmbH is one of the leading suppliers of high-quality systems and process technologies for industrial component cleaning with aqueous media. The systems are used in the mechanical engineering, automotive, aerospace and general industry sectors, among others. With its High Purity division, LPW is also a sought-after partner in sectors with fine and ultra-fine cleaning tasks such as the medical technology, optical and semiconductor industries.