Dürr business figures for 2024: record order intake and sales growth

According to preliminary business figures, the Dürr Group achieved record order intake in 2024, benefiting from high investments by the automotive industry in highly automated and sustainable painting technology. Compared to the previous year, orders grew by 11% to € 5.14 billion. Turnover also reached a new high of € 4.70 billion.

According to Dürr's preliminary business figures for 2024, free cash flow exceeded the threshold of € 100 million for the fifth time in succession at € 157 million. At 5.5%, the EBIT margin before extraordinary effects was at the upper end of the forecast corridor (4.5 to 6.0%). Dr. Jochen Weyrauch, CEO of Dürr AG: "The record order intake underscores our resilience in an economic environment characterized by uncertainty. Our strategic focus on sustainability and automation has paid off. In painting technology, we are benefiting from a robust modernization cycle. The automotive industry is replacing old paint shops with energy-saving systems with extensive automation in order to be able to produce efficiently and in a climate-friendly manner." The Management Board is forecasting growth in turnover and margins for 2025. The concentration on the core business initiated in 2024 will continue: "We are creating a focused Group structure with three divisions instead of five: Automotive, Industrial Automation and Woodworking. We are strengthening these businesses through continuous optimization and investments in order to grow profitably."

Dürr with high order intake

The high order intake was mainly driven by long-term major orders from the automotive industry. The largest project involves the construction of a paint shop in Germany, which will set new standards in terms of energy consumption. Other major orders came from Southern Europe, America and South Korea, for example. "In older car plants, over 40% of energy consumption is accounted for by painting. Manufacturers are increasingly investing in economical technologies in order to reduce costs and emissions," says Dürr CEO Weyrauch, explaining the demand for energy-efficient technologies. In the woodworking machinery business operated by Group subsidiary Homag, demand remained weak since the end of 2022. Battery production technology recorded a growth spurt. In this forward-looking business area, orders rose to well over € 100 million as Dürr received its first major order in Italy for the delivery of several electrode coating lines. In the Industrial Automation Systems division, the full-year inclusion of the BBS Automation Group, which was acquired in 2023, boosted incoming orders to € 671 million. However, the slow growth of electromobility slowed demand for automated production technology.

Rising Group sales and high investments at Dürr

Group sales rose by 1.5% to € 4.70 billion, although Homag contributed over € 200 million less due to the previous year's decline in orders. EBIT before extraordinary effects amounted to € 258 million and was € 23 million lower than in the previous year. It should be noted that Homag's contribution to earnings fell by € 79 million due to lower sales. The majority of this decline was compensated for within the Group by good earnings levels in the automotive business, environmental technology and service. Earnings after tax nevertheless fell by 7.3% as interest and tax expenses increased. Capital expenditure rose by 20% and reached a high level of € 189 million. At the end of 2024, the Dürr Group employed 19,894 people, 703 fewer than in the previous year (-3.4%). The decline was mainly due to job cuts at Homag and the sale of the Danish filling technology company Agramkow with around 180 employees. Around 9,200 people are employed in Germany (46% of the workforce).

Transformation process at Dürr and outlook for 2025

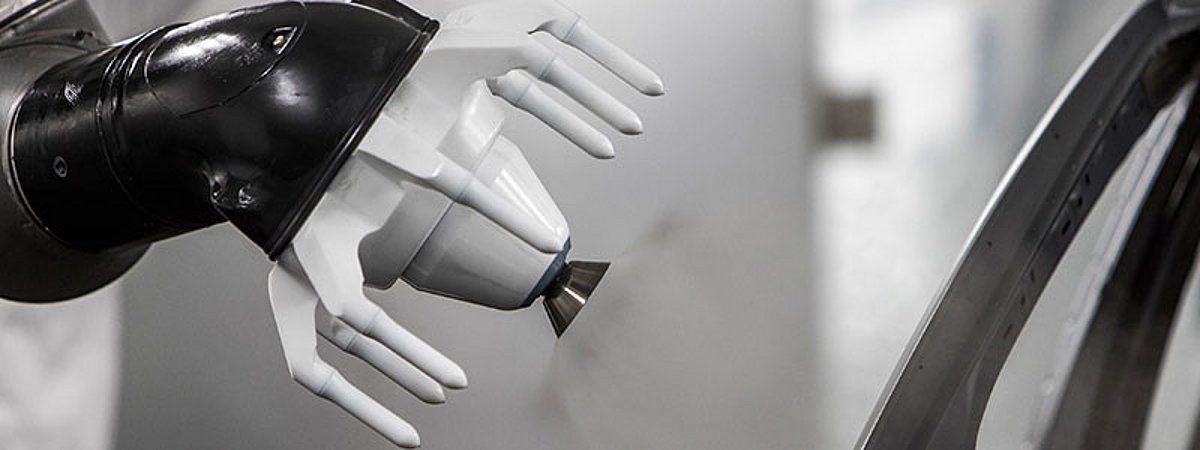

A far-reaching transformation process has been underway in the Dürr Group since mid-2024. The aim is to strengthen the core business, simplify the Group structure and focus even more consistently on automation as the lead technology. Part of the realignment is also the merger of the Paint and Final Assembly Systems and Application Technology divisions, which are active in the automotive business. Since the beginning of 2025, they have formed the new Automotive division, which bundles the paint technology business and also includes final assembly technology. Automotive is the largest division with almost 6,700 employees and sales of € 2.1 billion. By bundling paint technology under the umbrella of Automotive, the global market leader Dürr expects to achieve even better customer service, integrated product development and greater efficiency in the construction of turnkey paint shops. The outlook for 2025 is based on current forecast data on the development of the global economy and the assumption that geopolitics will not have a significant impact on global trade. For 2025, the Executive Board expects incoming orders of € 4.7 to 5.2 billion for the Group as a whole. Sales are expected to increase to between € 4.7 billion and € 5.0 billion in 2025, which corresponds to growth of up to 6%. The EBIT margin before special items is also expected to increase; the target range is 5.5% to 6.5%.